| ||||||

Godbe Research completed the twenty minute phone survey and found, "Overall Lafayette voters placed major city services including preserving open spaces, repairing streets and road, reducing traffic congestion and reducing crime at the same or higher level of importance than preventing local tax increases," noted a summary presented at the February 8 City Council meeting.

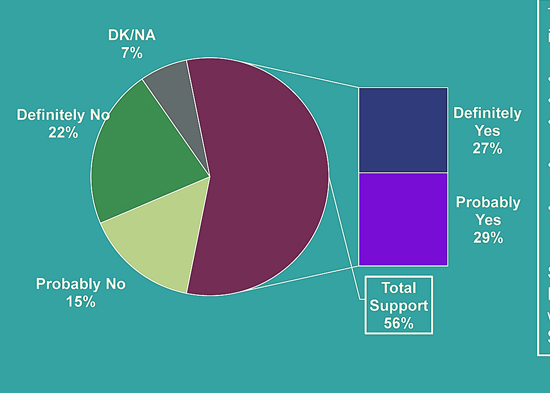

A total of 56% of respondents answered definitely yes or probably yes to the question, "To maintain and improve city services; including: repairing and maintaining local streets; extending library hours and services; maintaining police services; preserving open spaces; maintaining downtown landscaping and increasing parking; Shall the City of Lafayette increase the Real Property Transfer Tax, which is collected when a property is sold, by $7 per $1,000 dollars of the sales price?" A simple majority, just over 50%, is the threshold needed to pass the measure. The California Constitution allows a city to use either statewide general law to govern or to adopt their own municipal constitution as a charter city. A charter city has the power to legislate and regulate in response to the needs of the community. The impetus for the survey was a recommendation of the Finance Review Task Force for revenue enhancement options to primarily deal with a huge, over $15 million, road repair backlog.

"This has a moderately good chance of being successful," said Bryan Godbe, President of Godbe Research. The current real estate transfer tax is $1.10 per $1,000 of assessed value of a home that is sold - half of this amount, $.55/$1,000 goes to Contra Costa County, with the remaining half going to the City of Lafayette.

Godbe also said that the survey recorded an all time high: A total of 97% respondents said they were very satisfied or somewhat satisfied with Quality of Life in Lafayette. He said he'd never seen anything like it. Lafayette beat out former winner Marin County - they scored of 92% on "Quality of Life."

One of the main arguments in favor of moving Lafayette from a general law city to a charter city is that funds raised must stay in Lafayette - neither the County nor the State can grab these tax revenue dollars. Funds raised would go toward repairing the 17% of Lafayette streets that have received a failing grade. Other benefits could include increasing funding to preserve open space, additional police services, increasing parking - all high priority concerns of those polled.

Various levels of taxation were surveyed - $9 per $1,000 of assessed home value, $7, $5 and $3. At the $5 level 59 % of respondents answered probably yes or definitely yes that they would support this increased transfer tax rate.

"In a 'normal' year, one not fraught with the housing bubble collapse, we collect about $284,000 in property transfer taxes. Since this rate (at $5/$1,000) is nine times higher than the current rate - that translates to about $2.5M annually," said Tracy Robinson, Administrative Services Director.

By comparison, other Bay Area charter cities have substantially higher property transfer tax rates: Berkeley $15/$1,000, Alameda $12/$1,000 and Piedmont at $13/$1,000.

"This is a gigantic leap for us - it allows us to solve the police services problem and road problem in one swoop," said City Manager Steven Falk. "There's a big upside - we should pursue this further."

Reach the reporter at:

Copyright