| ||||||

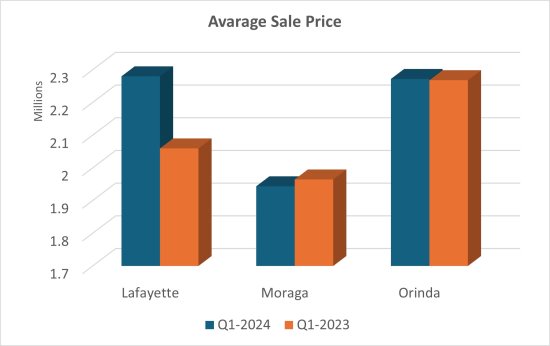

The average sales price has increased over a year ago in Lafayette and Orinda, and in Moraga there was a minimal drop. The days on market remained short and the homes that had multiple offers were plentiful.

Per Contra Costa Association of Realtors statistics reported from Jan. 1 through March 31, 2024, 51 single family homes closed in Lafayette. A year ago there were 35 and in 2022 there were 66. Sales prices ranged from $981,000 to $6,500,000 and the average number of days on market was 19. The average sales price was $2,280,036. A year ago it was $2,059,520.

In Moraga, the number of single-family closings was 17. A year ago it was 13 in the first quarter, and well below the 26 in 2022. Prices so far this year have ranged from $1,200,001 to $2,800,000. The average sale price was $1,943,694, a slight drop from the first quarter of 2023 when it was $1,964,615, and a drop from the record first quarter in 2022 of $2,350,260. The average marketing time was nine days the lowest it has been in many years.

In Orinda, the number of single-family closings was 33; in 2023 it was 28. Sales prices ranged from $1,075,000 to $4,970,000 with an average price of $2,272,000. A year ago it was $1,919,205. In the first quarter of 2022 it was $2,268,258. It took an average of 22 days on the market to sell a home versus 40 days on the market to sell a home in Orinda in the first 90 days of 2023.

In the first quarter of 2023, Lafayette homes sold at an average of $830.62 - an increase from the $812.92 per square foot last year. Moraga came in at $816.58, a slight drop from the 840.12 a year ago. Orinda was at $829.38; one year ago it was $773.00.

Again, as the number of closings in the first quarter usually contain a much smaller sample size, these numbers are different and can be affected by just one or two closings at the high end or the low end.

In the condominium/town home category, Lafayette had three resale closings reported to the MLS (what does this stand for?). They ranged from $925,000 to $1,350,000. Moraga again had eight, ranging from $448,444 to $1,660,000. Orinda had four from $445,000 and $1,460,000. One of the four was a BMR (Below Market Rate) sale for $609,000 on Hazel Tree Ridge.** BMR sales are limited on the prices where they can transfer so they can also affect the average sales prices. **

As of April 3, 2024, there were only 57 homes under contract per the MLS in the three combined communities (a year ago it was 38, in 2022 it was 94, and in 2021 it was well over 100.) The asking prices are between $899,000 to $4,895,000. This again points to the lack of supply of homes that have hit the market since the middle of February.

Inventory is at 66, comparable to the 64 a year ago and 60 at this same point in 2022.

There are 34 Lafayette properties currently on the market versus 30 properties on the market in April, 2023. Asking prices in Lafayette currently range from $999,000 to $9,495,000. In Moraga, buyers have their choice of 13 homes, the same as the 13 homes at this time in 2023. The price range is $425,000 to $2,695,000.

In Orinda there are 19 homes on the market. One year ago there were 21. The list prices range from $1,550,000 to $12,900,000.

There are no distressed (bank-owned or short sale) properties available in Lamorinda.

As is the case nearly every quarter, the most active price range is in the more affordable ranges. At the high end, 18 homes sold above $3,000,000 in the three communities combined. The affordability factor is subject to a lot of interpretation. There are 13 currently available above this amount in Lamorinda.

Interest rates have stayed above historical lows, which have pushed some buyers either out of the market, to lower priced homes, or out of Lamorinda. Relocation from the corporate side has continued to increase as companies now want their employees to work out of their destination offices versus working remotely from their old locations.

Lamorinda continues to be attractive with, BART access and highly rated schools. The real estate markets in Oakland, Berkeley, and Piedmont have continued to be active, so there has been some spillover effect where buyers are willing to make longer commutes in order to find more affordable housing. Of course, Lamorinda and affordable housing is also subject to interpretation.

We also continue to see a lot of buyers in Lamorinda being represented by agents based in San Francisco and the Peninsula. Prices in those areas have been higher for many years, so many have sold to buy more house for less money in Lamorinda.

Lastly, it is important to look at what homes are selling for versus their list prices. On occasion, homes come on the market at unrealistic prices and they do not sell. We also are seeing more homes listed well below true values in the hope it will encourage bidding wars that ultimately generate a higher overall sales price. In the first quarter of this year many homes have had multiple offers and have sold at or above the list price.

Of the 51 single-family home sales that closed in Lafayette in the first quarter of 2024, 32 sold at or above the list price. In Moraga, 14 of the 17 sales sold at or above the asking price, and in Orinda, 23 of the 33 sold at or above the final listing price.

This will typically happen when a house goes pending in the first two weeks on the market. Of the 57 currently pending sales in the three Lamorinda communities combined, 40 went pending in 14 days or less. The actual average days on the market would be markedly lower, but many agents are setting up marketing plans where they market the home to the public and to brokers and follow with an offer date in a week or so after exposing the property to the market pointing to a high likelihood of a continued trend in homes selling above the asking price.

In the detached home category in the first quarter of 2024, the average sale price in Lafayette was 102.7% of the final asking price. In Moraga it was 102% and in Orinda it was 103% .

Reach the reporter at: